Embark on a journey into the world of managing freelance income with QuickBooks for beginners. Discover how this powerful tool can revolutionize the way freelancers track and organize their earnings.

Introduction to Managing Freelance Income with QuickBooks for Beginners

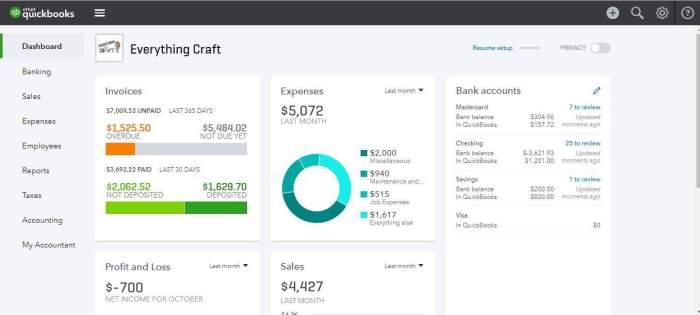

Managing freelance income refers to the process of organizing and monitoring the money earned through freelance work. This includes tracking payments from clients, managing expenses, and ensuring accurate financial records. As a freelancer, it is crucial to have a system in place to effectively manage income to maintain financial stability and make informed business decisions.Using QuickBooks can greatly benefit freelancers in managing their income.

QuickBooks is a popular accounting software that offers features specifically designed for small businesses and self-employed individuals. It provides tools for invoicing, expense tracking, financial reporting, and tax preparation, making it easier for freelancers to stay organized and compliant with financial obligations.For beginners, QuickBooks offers a user-friendly interface and step-by-step guidance to simplify income tracking.

It allows freelancers to categorize income, record expenses, generate financial reports, and track payments easily. By utilizing QuickBooks, beginners can streamline their financial processes, save time, and have a clear overview of their freelance income, helping them make informed decisions for their business.

Setting Up QuickBooks for Freelance Income Management

To effectively manage freelance income using QuickBooks, it is essential to set up your account properly. This involves creating income categories for different freelance services and linking your bank accounts for seamless income tracking.

Creating a QuickBooks Account

To create a QuickBooks account, follow these steps:

- Go to the QuickBooks website and click on the "Sign Up" button.

- Enter your email address and create a password for your account.

- Follow the prompts to input your business information, such as name, address, and industry.

- Choose a subscription plan that best suits your needs and budget.

- Complete the registration process and log in to your new QuickBooks account.

Setting Up Income Categories

To categorize your freelance income effectively, follow these steps:

- Go to the "Settings" menu in QuickBooks and select "Chart of Accounts".

- Click on "New" to create a new account and choose the account type as "Income".

- Name the account based on the type of freelance service you provide (e.g., Writing Services, Graphic Design, Consulting).

- Save the account, and repeat the process for each freelance service category you offer.

Linking Bank Accounts for Income Tracking

To link your bank accounts for seamless income tracking, here's what you need to do:

- In QuickBooks, go to the "Banking" menu and select "Connect an account".

- Search for your bank and enter your login credentials to securely link your account.

- QuickBooks will automatically import your bank transactions, making it easier to track your freelance income.

- Ensure to regularly reconcile your bank transactions with your income categories to maintain accurate financial records.

Recording Freelance Income in QuickBooks

When managing freelance income in QuickBooks, it is crucial to accurately record income from different clients to maintain financial transparency and organization. Properly categorizing income and generating income reports are essential for tracking earnings effectively and making informed financial decisions.

Categorizing Income for Effective Tracking

- Assign specific categories to income sources: Create distinct categories for each client or type of project to easily differentiate income sources.

- Utilize subcategories for detailed tracking: Break down income categories further with subcategories based on project type, payment method, or any other relevant criteria.

- Regularly review and adjust categories: Periodically review income categories to ensure they accurately reflect your freelance work and make adjustments as needed.

Generating Income Reports for Analysis

- Access the Reports tab in QuickBooks: Navigate to the Reports tab to access a variety of preset income reports or create custom reports tailored to your specific needs.

- Customize reports for detailed insights: Customize income reports by selecting date ranges, income categories, and other filters to gain detailed insights into your earnings.

- Analyze trends and identify opportunities: Use income reports to analyze trends in your freelance income, identify high-earning clients or projects, and uncover opportunities for growth and improvement.

Managing Expenses and Invoices in QuickBooks

Managing expenses and invoices are crucial aspects of freelance income management in QuickBooks. Properly inputting and categorizing expenses, creating and sending invoices, as well as tracking payments and outstanding invoices, ensures accurate financial records and smooth cash flow for freelancers.

Inputting and Categorizing Freelance Expenses

- Start by navigating to the "Expenses" tab in QuickBooks and selecting "New Expense".

- Enter the expense details such as date, payee, amount, and category.

- Make sure to categorize each expense correctly to track spending and for tax purposes.

- Utilize subcategories for further breakdown of expenses like office supplies, software subscriptions, or travel costs.

- Save the expense to record it accurately in your financial records.

Importance of Creating and Sending Invoices

- Invoicing is essential for freelancers to request payment for services rendered.

- Create professional invoices in QuickBooks with details such as client name, services provided, rates, and payment terms.

- Sending invoices promptly helps in maintaining a steady cash flow and ensures timely payments from clients.

- Include payment options and due dates on invoices to make it convenient for clients to settle their bills.

Tracking Payments and Outstanding Invoices

- Monitor payments received by reconciling bank transactions with invoices in QuickBooks.

- Mark invoices as paid once the payment is received to keep track of outstanding payments.

- Send reminders for overdue invoices to prompt clients for payment and maintain healthy cash flow.

- Generate reports in QuickBooks to analyze payment trends, outstanding invoices, and overall financial performance.

Utilizing QuickBooks Features for Financial Planning

Utilizing the features of QuickBooks for financial planning can help freelancers stay organized and on top of their finances. From creating budgets to tracking financial goals, QuickBooks offers a range of tools to assist in managing income and expenses effectively.

Creating Budgets and Tracking Financial Goals

Creating a budget in QuickBooks allows freelancers to set financial goals and monitor their progress. By inputting estimated income and expenses, freelancers can compare their actual financial performance against the budgeted amounts. This feature provides valuable insights into spending habits and helps in making informed financial decisions.

- Set specific financial goals and allocate budgeted amounts to different expense categories.

- Regularly review budget vs. actual reports to track progress and make adjustments as needed.

- Utilize QuickBooks' forecasting tools to predict future income and expenses based on past performance.

Benefits of Using QuickBooks for Tax Preparation

QuickBooks simplifies the tax preparation process for freelancers by organizing income, expenses, and deductions in one central location. With tax time approaching, freelancers can generate reports and export data to share with their accountants seamlessly. This streamlines the tax filing process and reduces the risk of errors.

- Generate tax reports, such as profit and loss statements and expense summaries, to streamline tax preparation.

- Track deductible expenses throughout the year to maximize tax savings.

- Utilize QuickBooks' tax tools to ensure compliance with tax regulations and deadlines.

Tips on Forecasting Income and Expenses using QuickBooks Tools

QuickBooks offers tools for freelancers to forecast income and expenses, helping them plan for the future and make informed financial decisions. By analyzing historical data and trends, freelancers can anticipate cash flow fluctuations and adjust their financial strategy accordingly.

- Use QuickBooks' cash flow forecasting feature to predict future income and expenses.

- Regularly update income and expense records to ensure accurate forecasting.

- Consider different scenarios and factors that may impact income and expenses, such as seasonality or market trends.

Final Thoughts

In conclusion, Managing Freelance Income with QuickBooks for Beginners offers a game-changing solution for freelancers looking to streamline their financial management. Take control of your income with ease and efficiency.

Answers to Common Questions

How can QuickBooks simplify income tracking for beginners?

QuickBooks provides a user-friendly interface and customizable features that make it easy for beginners to track their income sources efficiently.

Why is it important to categorize income in QuickBooks?

Categorizing income helps freelancers analyze their earnings by service type or client, providing valuable insights for financial planning.

Can QuickBooks help with tax preparation?

Yes, QuickBooks offers tools to assist freelancers in organizing their financial data for tax purposes, simplifying the process.