When comparing QuickBooks Self Employed and Traditional Accounting Software, it's essential to understand the intricacies of each. Dive into this enlightening discussion that sheds light on the key differences and benefits of both options.

In the following paragraphs, we will explore the pricing, features, user experience, integration, and more to help you make an informed decision for your accounting needs.

Overview of QuickBooks Self Employed and Traditional Accounting Software

QuickBooks Self Employed is a user-friendly accounting software designed specifically for freelancers, independent contractors, and sole proprietors. It offers features tailored to the needs of self-employed individuals to manage their finances efficiently.

Main Features of QuickBooks Self Employed:

- Automated expense tracking to categorize business expenses

- Invoicing capabilities to bill clients and get paid faster

- Mileage tracking for accurate deductions

- Tax deduction suggestions to maximize savings

- Integration with bank accounts for real-time financial data

Key Characteristics of Traditional Accounting Software:

Traditional accounting software is designed for larger businesses and offers more comprehensive features than QuickBooks Self Employed. It is suitable for companies with multiple employees and complex financial transactions.

- Advanced reporting and analysis tools for business performance evaluation

- Inventory management for tracking stock levels and sales

- Payroll processing to manage employee salaries and benefits

- Accounts payable and receivable management for handling vendor and customer payments

- Customization options to tailor the software to specific business needs

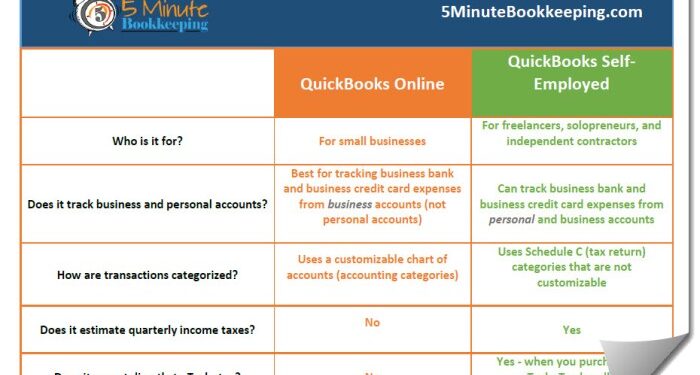

Comparison of Target Users:

QuickBooks Self Employed targets self-employed individuals who need a simple and intuitive accounting solution to manage their finances effectively. On the other hand, traditional accounting software caters to larger businesses with more complex financial needs, multiple employees, and intricate reporting requirements.

Pricing and Cost Comparison

When it comes to choosing between QuickBooks Self Employed and traditional accounting software, one of the key factors to consider is the pricing and overall cost. Let's break down the pricing structure for QuickBooks Self Employed and explore the cost considerations associated with traditional accounting software.

QuickBooks Self Employed Pricing

QuickBooks Self Employed offers a simple pricing structure with a monthly subscription fee. The cost typically ranges from $15 to $25 per month, depending on the plan you choose. This subscription fee gives you access to essential features like tracking income and expenses, invoicing, estimating quarterly taxes, and mileage tracking.

However, it is important to note that additional fees may apply for certain advanced features or add-ons.

Traditional Accounting Software Cost Considerations

Traditional accounting software often comes with a higher upfront cost compared to QuickBooks Self Employed. Users may need to purchase a software license or pay a one-time fee, which can range from a few hundred to thousands of dollars, depending on the complexity of the software and the number of users.

In addition to the initial cost, users may also need to pay for software updates, technical support, and training.

Hidden Fees and Additional Charges

While QuickBooks Self Employed offers a straightforward monthly subscription fee, traditional accounting software may come with hidden fees and additional charges. Users may encounter costs for software updates, technical support, data storage, and add-on features. It is important to carefully review the pricing details and terms of service to understand the full cost of using traditional accounting software.

Features and Functionality

When comparing QuickBooks Self Employed with traditional accounting software, it's essential to look at the specific features and functionality each offers to help self-employed individuals manage their finances effectively.

QuickBooks Self Employed

- QuickBooks Self Employed is designed specifically for freelancers, independent contractors, and sole proprietors, offering features tailored to their needs.

- It provides easy-to-use invoicing tools to create and send professional invoices to clients, helping users get paid faster.

- Expense tracking is simplified with the ability to categorize expenses and track mileage automatically, making it easier to monitor business spending.

- Reporting capabilities in QuickBooks Self Employed allow users to generate reports on income and expenses, giving a clear picture of their financial health.

- The software also offers tax preparation features, helping self-employed individuals stay organized and prepared for tax season.

Traditional Accounting Software

- Traditional accounting software, on the other hand, is more comprehensive and typically offers a wider range of features beyond just invoicing and expense tracking.

- These software solutions often include more advanced reporting capabilities, customizable charts of accounts, and the ability to handle more complex financial transactions.

- Customization options in traditional accounting software allow users to tailor the software to their specific business needs, such as creating custom reports or integrating with other business tools.

- While traditional accounting software may have a steeper learning curve compared to QuickBooks Self Employed, it provides more robust functionality for businesses with more complex financial needs.

User Experience and Ease of Use

When it comes to user experience and ease of use, accounting software plays a crucial role in helping users manage their finances efficiently. Let's delve into how QuickBooks Self-Employed and traditional accounting software compare in terms of user experience.

QuickBooks Self-Employed Navigation

QuickBooks Self-Employed has garnered positive feedback for its user-friendly interface and intuitive design. Users appreciate the simple navigation and easy-to-understand layout, making it a breeze to track income and expenses, invoice clients, and manage taxes. The clean interface of QuickBooks Self-Employed contributes to a seamless user experience, especially for individuals who may not have a background in accounting.

Learning Curve with Traditional Accounting Software

On the other hand, traditional accounting software often comes with a steep learning curve. Users who are not familiar with accounting principles may find it challenging to navigate through complex menus and features. The extensive functionalities of traditional accounting software require users to invest time in understanding how to use the software effectively, which can be overwhelming for beginners.

User Interface and Overall Experience

QuickBooks Self-Employed prioritizes simplicity and ease of use, catering to self-employed individuals who seek a straightforward solution for managing their finances. The user interface is designed to be intuitive, with key features easily accessible for quick navigation. In contrast, traditional accounting software may feel overwhelming due to the abundance of features and settings that can be daunting for users without a background in accounting.Overall, QuickBooks Self-Employed stands out for its user-friendly interface and ease of navigation, making it a preferred choice for self-employed individuals looking for a hassle-free accounting solution.

Integration and Compatibility

When it comes to integration and compatibility, both QuickBooks Self Employed and traditional accounting software have their own strengths and limitations. Let's take a closer look at how they fare in terms of integrating with other tools and platforms.

Integration with Other Tools

- QuickBooks Self Employed offers seamless integration with various popular tools and platforms such as PayPal, Shopify, and Square. This allows users to easily sync their financial data across different platforms and streamline their accounting processes.

- On the other hand, traditional accounting software may require additional plugins or custom development to integrate with other tools. The compatibility and ease of integration can vary depending on the specific software being used.

Compatibility with Operating Systems

- QuickBooks Self Employed is a cloud-based software that can be accessed from any device with an internet connection. This makes it compatible with both Windows and Mac operating systems, as well as mobile devices like smartphones and tablets.

- Traditional accounting software, on the other hand, may have specific system requirements and may not be as flexible in terms of operating system compatibility. Users may need to ensure they have the right system specifications to run the software smoothly.

Third-Party Apps Integration

- QuickBooks Self Employed can be easily integrated with popular third-party apps like TSheets for time tracking, Expensify for expense management, and Stripe for online payments. This allows users to customize their accounting workflow and enhance productivity.

- Traditional accounting software may also offer integrations with third-party apps, but the process may be more complex and require additional setup. Examples include integrating with CRM systems, project management tools, and inventory management software.

Final Wrap-Up

In conclusion, the choice between QuickBooks Self Employed and Traditional Accounting Software ultimately depends on your specific requirements and preferences. We hope this comparison has provided valuable insights to guide you in selecting the right software for your business.

Detailed FAQs

Is QuickBooks Self Employed suitable for freelancers and independent contractors?

Yes, QuickBooks Self Employed is designed specifically for freelancers and independent contractors to manage their finances efficiently.

Can traditional accounting software be customized to suit specific business needs?

Traditional accounting software often offers customization options to tailor the software to meet the unique requirements of different businesses.

Does QuickBooks Self Employed offer automatic bank syncing for easy transaction tracking?

Yes, QuickBooks Self Employed allows users to connect their bank accounts for automatic syncing of transactions, making it convenient for tracking expenses.

Are there any hidden fees associated with traditional accounting software?

Some traditional accounting software may have hidden fees for additional features or upgrades, so it's important to review the pricing details carefully.