Embarking on the journey of starting a business can be daunting, especially when it comes to securing funding. In this guide, we will explore the various options available to entrepreneurs, from traditional sources like bank loans to innovative methods like crowdfunding.

Get ready to dive into the world of startup business funding!

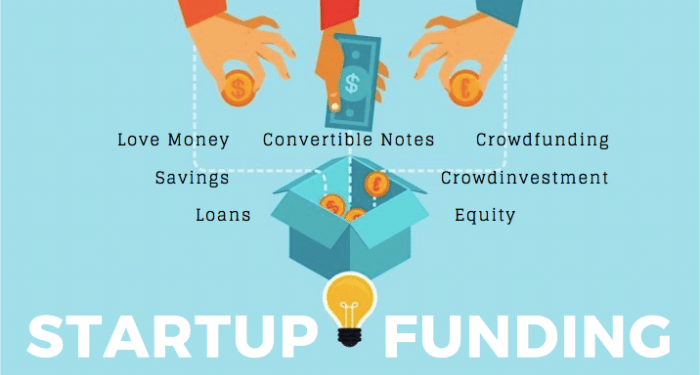

Sources of Funding

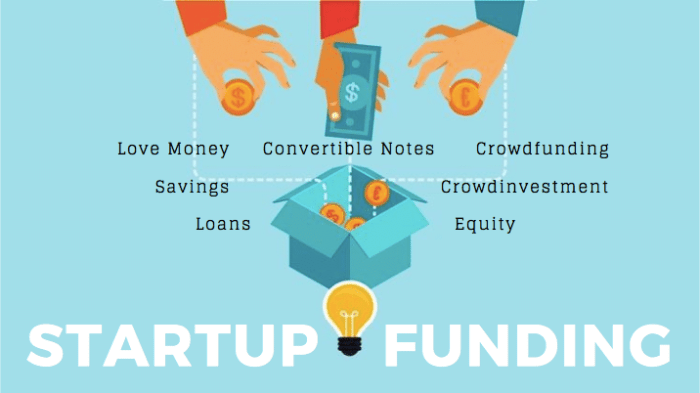

Entrepreneurs have various options when it comes to funding their startup businesses. These options can range from traditional sources like bank loans to alternative methods such as crowdfunding. Let's explore some of the common funding avenues available:

Traditional Funding Sources

- Bank Loans: Entrepreneurs can apply for loans from banks to finance their business ventures. These loans typically come with interest rates and repayment terms.

- SBA Loans: The Small Business Administration (SBA) offers loan programs to help small businesses access funding. These loans are partially guaranteed by the SBA, making them more accessible to entrepreneurs.

- Angel Investors: Angel investors are individuals who provide capital to startups in exchange for ownership equity. They often offer expertise and guidance along with their investment.

Alternative Funding Options

- Crowdfunding: Entrepreneurs can raise funds from a large number of people through online platforms. This method allows for public support and validation of the business idea.

- Venture Capital: Venture capital firms invest in startups with high growth potential in exchange for equity. They provide not just funding but also mentorship and networking opportunities.

- Bootstrapping: Bootstrapping involves self-funding the business using personal savings or revenue generated by the business. While it may limit growth initially, it gives entrepreneurs full control over their business.

Government Grants and Programs

Government grants and programs play a crucial role in providing financial support to startup businesses, helping them grow and succeed. These grants are often tailored to specific industries or demographics, providing targeted assistance to those who need it most.

Types of Government Grants

- Federal Grants: Offered by the federal government to support businesses in various sectors, such as technology, healthcare, and renewable energy.

- State Grants: Provided by state governments to promote economic development and job creation within their jurisdictions.

- Minority Grants: Specifically designed to assist minority-owned businesses in accessing funding and resources.

Application Process and Eligibility Criteria

Applying for government grants typically involves submitting a detailed proposal outlining the business plan, financial projections, and intended use of the funds. Eligibility criteria may vary depending on the specific grant, but common requirements include being a registered business, demonstrating financial need, and having a viable business model.

Benefits of Government Funding

- Non-Repayable: Unlike loans, government grants do not need to be repaid, providing a valuable source of funding without incurring debt.

- Support and Resources: In addition to financial assistance, government programs often offer mentorship, networking opportunities, and access to specialized resources.

- Credibility and Validation: Securing government funding can enhance the credibility of a startup and validate its business concept in the eyes of investors and stakeholders.

Accelerators and Incubators

Accelerators and incubators play a crucial role in funding and nurturing startup businesses by providing a structured program of support, mentorship, and resources to help entrepreneurs grow and scale their ventures.

Role of Accelerators and Incubators

Accelerators and incubators typically offer funding in exchange for equity, access to a network of mentors and industry experts, workspace, and various resources to help startups succeed. They provide intensive, short-term programs that focus on accelerating the growth of early-stage companies.

Comparison of Accelerator and Incubator Programs

- Funding: Accelerators usually provide seed capital in exchange for equity, while many incubators offer free workspace and resources without direct funding.

- Mentorship: Accelerators offer mentorship from experienced entrepreneurs and industry professionals to guide startups, while incubators focus more on providing access to a network of advisors.

- Networking Opportunities: Both accelerators and incubators provide valuable networking opportunities with potential investors, partners, and customers to help startups expand their reach.

Success Stories of Startups Benefiting from Accelerator or Incubator Programs

- Airbnb: Airbnb participated in the Y Combinator accelerator program, which provided the initial funding and mentorship that helped the company grow into a global hospitality giant.

- Dropbox: Dropbox went through the TechStars accelerator program, where they received funding, mentorship, and access to a network of investors that played a crucial role in their success.

- Twitch: Twitch, a live streaming platform for gamers, was part of the 500 Startups accelerator program, which helped them secure funding and strategic partnerships that fueled their growth.

Online Lending Platforms

Online lending platforms have become a popular funding option for entrepreneurs in recent years. These platforms provide a convenient and quick way for startups to access the capital they need to grow their business. Unlike traditional lending institutions, online lending platforms offer a streamlined application process and faster approval times.

How Online Lending Platforms Work

Online lending platforms connect borrowers with investors who are willing to lend money at competitive interest rates. Entrepreneurs can apply for a loan online by providing information about their business and financial history. The platform then evaluates the application and matches the borrower with potential lenders.

Once approved, the funds are deposited into the borrower's account quickly, allowing them to use the money for business purposes.

Benefits of Online Lending Platforms

- Quick Approval: Online lending platforms have faster approval times compared to traditional banks, allowing entrepreneurs to access funds when they need them.

- Flexible Terms: These platforms offer a variety of loan options with flexible repayment terms, making it easier for startups to manage their cash flow.

- Accessibility: Online lending platforms are accessible from anywhere with an internet connection, making it convenient for entrepreneurs to apply for funding.

- Competitive Rates: Many online lending platforms offer competitive interest rates, giving startups access to affordable financing options.

Tips for Choosing the Right Online Lending Platform

- Research: Take the time to research different online lending platforms and compare their terms and rates to find the best fit for your business.

- Read Reviews: Look for reviews and testimonials from other entrepreneurs who have used the platform to get an idea of their experience.

- Consider Fees: Be aware of any fees associated with the loan, such as origination fees or prepayment penalties, and factor them into your decision.

- Check Eligibility: Make sure you meet the platform's eligibility criteria before applying to increase your chances of approval.

Summary

From government grants to online lending platforms, the landscape of startup business funding is vast and full of opportunities. As you navigate through the possibilities, remember that the right funding option can be the key to turning your entrepreneurial dreams into reality.

FAQ Resource

What are the main sources of funding for startup businesses?

Startup businesses can explore traditional options like bank loans, SBA loans, and angel investors, as well as alternative methods such as crowdfunding and venture capital.

Are there specific government grants available for startups?

Yes, there are government grants tailored to different industries and demographics, providing support for startups in various sectors.

How do online lending platforms differ from traditional lending institutions?

Online lending platforms offer a quicker and more streamlined process compared to traditional banks, making them a popular choice for entrepreneurs seeking funding.